- The EUR/USD weekly forecast is turning bearish due to the looming April tariffs.

- The Fed kept interest rates unchanged, as expected.

- Fed policymakers maintained the call for patience amid tariff uncertainty.

The EUR/USD weekly forecast is turning bearish as looming April tariffs threaten the outlook for major economies, including the Eurozone.

Ups and downs of EUR/USD

The euro had a bearish week as the dollar rebounded due to a cautious Fed and ahead of April’s reciprocal tariffs. However, at the start of the week, retail sales data revealed weak consumer spending in the US.

–Are you interested in learning more about crypto brokers? Check our detailed guide-

On Wednesday, the Fed kept interest rates unchanged as expected. Moreover, policymakers projected two rate cuts this year, maintaining the previous forecast. Policymakers maintained the call for patience amid tariff uncertainty. As a result, the dollar found some support.

Meanwhile, market participants were looking forward to reciprocal tariffs starting in April. More tariffs will likely increase inflation expectations, forcing the Fed to remain cautious.

Next week’s key events for EUR/USD

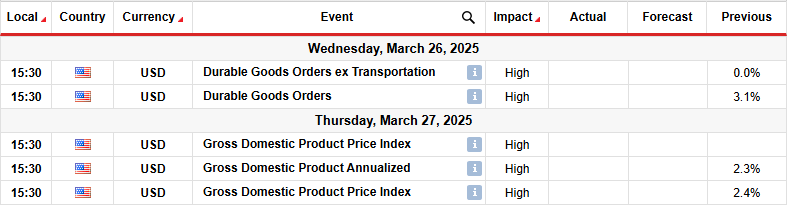

Next week, market participants will focus on economic releases from the US, including durable goods orders and gross domestic product. The GDP report will show the economy’s health and influence the outlook for Fed rate cuts.

Recent data has shown a slowdown in the US economy. Therefore, there is a high chance this trend will continue with downbeat GDP data. Such an outcome would increase expectations for Fed rate cuts, weighing on the dollar.